Indexed Universal Life (IUL)

What is Indexed Universal Life?

Indexed Universal Life Insurance is a permanent life insurance policy that earns interest based on the stock market's returns. Since it's a universal life policy, policyholders can change payments and benefits as needed. Like other forms of permanent life insurance, IULs offer a death benefit and a cash account. The death benefit is determined at the beginning of the policy. The cash account grows based on the performance of a stock index tied to the policy.

A stock index, such as the S&P 500, Barclays, or Dow Jones Industrial Average, is a way to track a group of stocks. Insurance companies pick one or more of these and pay interest to policyholders based on the index's performance - as value goes up the account earns interest. If the index drops, the account earns less or nothing.

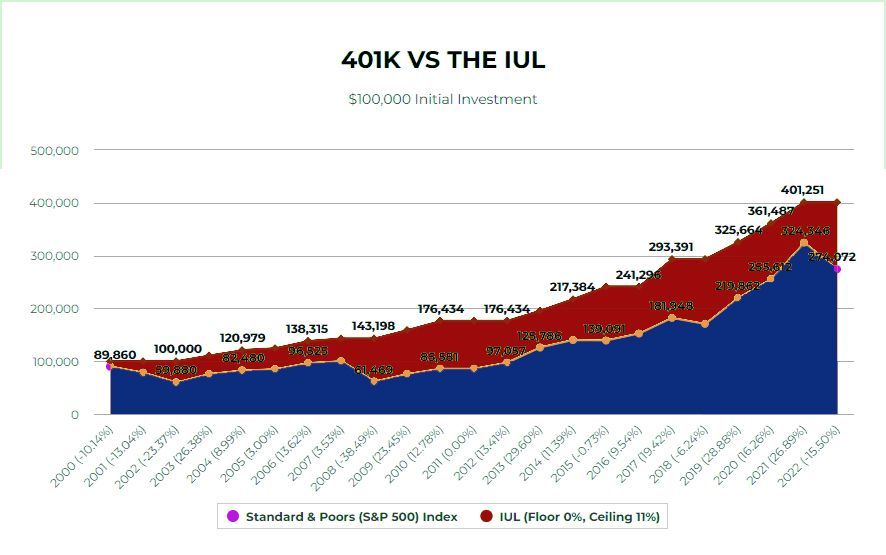

The amount you can earn is subject to "floors" and "ceilings" to help minimize losses and maximize long term growth. The floor is the lowest your account rate can go and is usually guaranteed for the life of the policy, but is often set at 0%. The ceiling is highest your account can be credited and is based on the performance of the the index chosen.

Example:

If the market plummets as it did in 2008 (-40%) and during the 2020 Covid - 19 pandemic (-30%), your policy will be credited 0% as opposed to taking a 30% or 40% loss like other traditional retirement accounts did.

How Do IULs Work?

Simply put, compound interest! Compound Interest has been called the 8th wonder of the world and has been used by savvy investors to help grow and compound wealth. By taking advantage of compound interest, you can position yourself to build up your savings over the long term as the magic of earning interest on interest helps expand your wealth and magnify your legacy.

What EXACTLY is COMPOUND INTEREST?

List of Services

-

Simple Interest

Interest earned on invested principal over multiple periods of time that DOES NOT take into account the interest earned in earlier periods. In other words, interest is only paid on principal, not on any interest earned on that principal.

-

Compound Interest

Interest earned on invested principal over multiple periods of time that DOES account for the interest earned on the principal in earlier periods. Interest is earned on interest plus principal when compound interest is used. It is this "compounding" of principal and interest that creates huge long-term accumulation.

A popular way to demonstrate the power of compound interest is to ask the question...

"What would you rather have, $1,000,000 or a penny doubled every day for 30 days?"

Most people choose one million dollars. However, taking a penny doubled everyday for 30 days is far and away the winner. IUL is a compounding interest earning machine!

THE IUL VS 401K...

Unlike with traditional 401(k)s, THE IUL is funded with non-qualified money, or after-tax dollars. So what you pay into IUL has been taxed already. That's good news for future income - tax free retirement income! IUL also offers the advantage of a tax efficient death benefit for loved ones.

- Money within a 401(k) plan is exposed to losses from market downfalls

- 401(k) plans don't let you borrow against them with the same flexibility as you might with IUL

- 401(k) withdrawals before age 59.5 are subject to a 10% penalty and income taxation

- Unlike with the 401(k), distribution from an IUL is non-taxable

- Withdrawals from a 401(k) are subject to more substantial tax liability

- There are less restrictions on contributions to an IUL policy than there are to a 401(k) plan

- In the 2020 tax year, the contribution limit for a 401(k) is set at $19,500. THAT's ALL!

- With its contractual guarantees, IUL offers the benefit of preserving your earning power in your professional working years

- Indexed universal life insurance can also be customized for different situations: there are riders for chronic illness, work disability, and other specialized circumstances

- You can pour money into the IUL while other retirement options have restrictions on the amount of contributions you can make

- You get life insurance that cannot be revoked

- You cannot lose your principal to a recession

- When you start withdrawing money in retirement it's tax-free! The federal government cannot look at a steady $100,000 a year withdrawal from your IUL, combine it with your $32,000 Social Security income and declare that you are making too much money then tax your Social Security money